Introduction:

India's spending on healthcare has been low for long time, with slow growth in spending in a setting of steadily increasing demand for healthcare due to increasing population, changing demographic scenario and life styles of population. Due to fiscal pressure facing the economy over a long period, there has been efforts to improve the access to quality healthcare services affordable to all population in rural and urban areas. During the last two decades, the government implemented series of health reforms to strengthen the public healthcare system and improving the delivery of healthcare services. However, there exists a number of challenges in providing universal health coverage to every citizen in the country.

Indian health system is not the only system facing the above challenges, due to low funding of healthcare services. Studies have compared other healthcare systems to understand whether those healthcare systems can provide some lessons (1-3). These studies focused on some specific aspects of healthcare system such as healthcare spending, prevalence rate of diseases, quality of care, and showed a mixed results of healthcare system performances. A comparative analysis on how the Indian healthcare system performs relative to other countries in the continent would be helpful but have been lacking.

One of the major goals of an effective healthcare system is to respond to the expectations and needs of the population by providing access to affordable and quality healthcare services and improving the health of every individual. An effective healthcare system it requires effective planning strategies that address the issues of equity, accessibility, quality and shared decision making focusing on people-centered healthcare (4). It is also essential that monitoring and evaluation of these strategies should be undertaken on continuous basis to maintain an effective healthcare system. There exist widespread disparities in the healthcare system performances in different countries primarily due to health system design, contents and management that leads to different outcomes such as health status, responsiveness or fairness in financing and delivery of healthcare services. Therefore, the policy makers at various levels of health care system should measure and quantify the variations in health system performance and determine the factors that impact the achievement of performance at various levels (5).

This study, therefore, using comparable data from international and national organizations sought to compare the Indian healthcare system with the Saudi healthcare system across four main domains: population and healthcare coverage, healthcare spending, healthcare system capacity, and health status. It is assumed that a healthcare system that reduces wastes and operate more efficiently will improve its performance than high spenders.

Methodology

We considered KSA for comparison primarily due to the fact that like India, KSA's constitution provides for free healthcare services to its citizens. Indian constitution accords provisions guaranteeing everyone's right to the highest attainable standard of physical and mental health. Article 21 of the constitution held that right to health is integral to the right to life and the government has a constitutional obligation to provide healthcare facilities to its citizens (6). However, the healthcare systems in these countries are structured in different ways. Both countries share similarities in major demographic indicators and are members of G20 countries, which is the premier forum for international economic cooperation. Secondary data were collected from a range of database published by the World Health Organization and the World Bank. Additional data related to health system capacity, health workforce and health status collected from the reports of the Ministry of Health (MOH) from respective countries, evaluation reports and documents by government and non-government agencies. Literature review was also conducted to elicit relevant information on different factors related to health system performance.

All income and expenditure data are converted into US$ equivalents, with exchange rates based on 2018 prices. We compared data on expenditure on healthcare, including proportion of spending coming from the public and private sectors. As India and KSA organize their healthcare package differently, we used national health accounts (NHA) data as a basis for comparison. Data on inputs such as health workforce, hospitals and hospital beds were taken from the annual reports of MOH of respective countries. The approach resulted in the compilation of major indicators across four domains: population and healthcare coverage, healthcare spending, health system capacity and health status. In each domain, we selected measures that were available in both countries in the analysis. The analysis of the study focused on indicators for 2018, as well as the trends in data from 2010 to 2018 or when available and comparable.

Results

Healthcare System in India

Healthcare system in India has been designed based on a federal structure with the roles and responsibilities of governance, financing and operation of healthcare system is shared between the central and state governments (7-8). At the central level, the Ministry of Health & Family Welfare (MoHFW) has the regulatory power to implement health policy decisions as well as organizing and delivery of all national health programs. State governments are primarily responsible for organizing and delivery of healthcare services to their population. India's healthcare delivery is characterized by a mix of public and private sectors. Although public health care is provided free of cost to the people, but due to various deficiencies at the public healthcare facilities, many families seek healthcare from the private sector by incurring out-of-pocket expenditure (9).

In India, private health sector plays a significant role in healthcare delivery. During the early 1950's the government's spending on healthcare was abysmally low, and private sector was invited to complement in those areas, where the public health sector presence was poor. Gradually, the private health sector has grown significantly, diversified over a period of time and became the first point of contact for the majority of population in both urban and rural areas. From 1352 hospitals/clinics in 1950, the private healthcare sector has grown rapidly over the last few decades. The economic reforms introduced by the government in the early 90's and pro-market strategies of the subsequent governments have further encouraged the private healthcare sector to invest in hospitals, high-end technologies and health workforce for delivering quality healthcare to the people. In 2016, it accounted for nearly 80% of out-patient visits and 60% of inpatients care in India (10-11). Most of the private healthcare spending was in the form of out-of-pocket payment by the families, and it was estimated that almost 62.4% of total healthcare spending was out-of-pocket payments (12).

Healthcare System in KSA

KSA is one of the richest and fast-growing economy in the Arab region with an estimated population of 35.01 million in 2020 (13). Since the discovery of oil resources in the 1930's, KSA has experienced rapid economic growth similar to that of other developed nations. Since the implementation of national development plan in 1970, KSA witnessed a remarkable transformation in healthcare system and brings significant improvement in health status of population. As per the constitution of KSA, the government provides free healthcare services to its citizens including those expatriates working in the government sector (14). Healthcare system in KSA is primarily a government funded and delivered, although the private health sector role has been increasing. Ministry of Health (MOH) is the major provider of healthcare services, while other ministries and government agencies are also involved in delivering health care to their employees and family members. MOH is involved management, planning, formulation of policies, and supervising the implementation of all health programs through its 20 regional directorates to achieve the overall objectives of healthcare system (15). During the time of crisis and emergencies, all healthcare providers collaborate and deliver services to the entire population (16). During the last two decades, there has been significant increase in government budget allocated to the MOH, from 2.8% in 1970 to 7.82% in 2021 (17).

The major difference between Indian and KSA's health systems is: while in KSA healthcare system, all decision making is centralized, where MOH oversees the policies and provision of healthcare services for its citizens and the expatriates which is in accordance with the long monarch rule in the Kingdom (18). Although the evolution of KSA health system traced back from 1925, it witnessed progress since the implementation of national development plan in 1970; period 2011-2020 is characterized as health service boom and future of health system has been planned under Saudi Vision-2030 (19-20). There has been significant advancement in the field of education, health awareness of people and standard of living during this period.

Health Coverage of Population

India's estimated population in 2020 is 1380 million, out of which the share of old age population 65 years and above constitutes 6.75%. KSA's population is 34.81 million in 2020, out of which 3.5% constitutes old age population 65 years and above (Table 1). While India has a public-private mix system of health care financing and provisioning, KSA's health system is mainly public funded and delivered. In 2018, about 40% of India's population is covered with some form of health insurance, which includes government sponsored health insurance schemes, social health insurance, private health insurance and community health insurance. KSA on the other hand provides free healthcare services to all citizens and expatriates working in the public sector. And for employees working in the private establishments are covered by mandatory employer based cooperative health insurance. Currently, about 12.92 million population is covered by health insurance scheme, which include 9.08 million non-Saudi nationals and .08 million expatriates together constitutes 38.6% of total population in 2018 (21).

| Table 1: Population and health coverage statistics for India and KSA, 2010 and 2018 |

| Population & health coverage |

India |

KSA |

2010 |

2018 |

Change |

2010 |

2018 |

Change |

Population (in million) |

1234.3 |

1318.7 |

84.4 |

27.42 |

33.70 |

6.28 |

Population over 65+ |

5.08 |

6.18 |

1.1 |

2.94 |

3.30 |

0.36 |

Population covered by health insurance |

25% |

44% |

19 |

30.6 |

38.6 |

8 |

UHC service coverage index (2017) |

48 |

55 |

7 |

73 |

74 |

1 |

| Source: WHO (2021). Global health observatory data repository |

In India, health insurance covers about 44% of its population in 2018 compared to 38.6% in KSA. However, the UHC service overage index is 55 in 2017 compared to 74 in KSA (Table 1). India has implemented multiple health insurance schemes providing coverage to central government employees, workers in the private sector, the poor and unorganized sector workers, and private voluntary health insurance schemes. The Central Government Health Scheme (CGHS) provides health insurance coverage for central government employees both serving and retired and their family members. The scheme provides coverage to 1.25 million primary card holders and 3.67 million beneficiaries (22). The Employees's State Insurance Scheme (ESIS), a social health insurance scheme for the workers in the organized private sector provides medical care as well as other benefits to about 135 million beneficiaries in 2019 (22). Rashtriya Swasthya Bima Yojana (RSBY), a national health insurance scheme provided health insurance coverage of up to Rs.30000 per family per annum to the poor families and workers belong to certain categories of unorganized sector. By 2018-19, the scheme covered 206.5 million people, which accounted for 65.5% of the target population (23). In 2018, the government launched Prime Minister's Jan Arogya Yajana (PMJSY), a flagship scheme which provides insurance coverage of up to Rs. 0.5 million to about 500 million poor for secondary and tertiary hospitalization. By August 2020, across the country more than 125 million people have registered under this scheme. Commercial health insurance also extends insurance coverage to significant share of Indian population. In 2018-19, about 472 million individuals are covered by various types of insurance schemes (22).

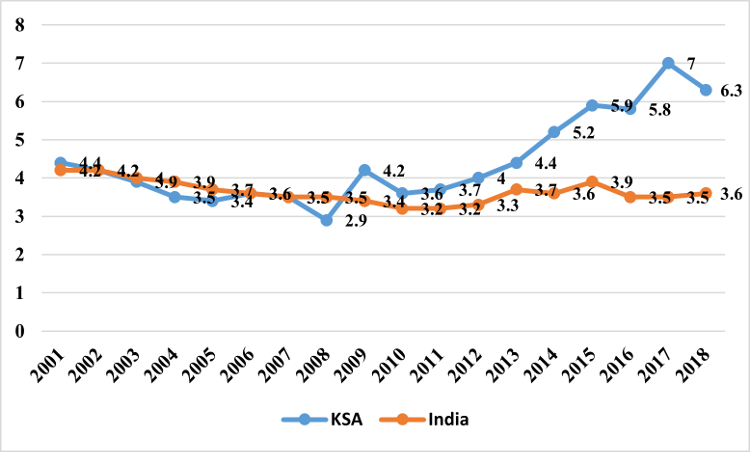

Expenditure on Healthcare

India has the lowest expenditure on healthcare compared to KSA. In 2018, India's health expenditure as percentage of GDP was 3.6%, which was just an increase of 0.33 from 2010. On the other hand, KSA's healthcare expenditure as percent of GDP was 6.36% in 2018, compared to 3.64% in 2010. In 2018, the current per-capita expenditure on healthcare in KSA of US$ 1484.6.is almost 20 times higher than India's per capita expenditure on healthcare (US$72.83). Despite introducing various health sector reforms, the rate of growth in total healthcare expenditure in India has not increased notably over the past decades. However, KSA's health expenditure as share of GDP has increased steadily after the implementation of cooperative health insurance, an employer contributed scheme in 2006 (Fig 1).

|

|

Fig 1. Healthcare expenditure as % of GDP -India and KSA (2001-2018)

|

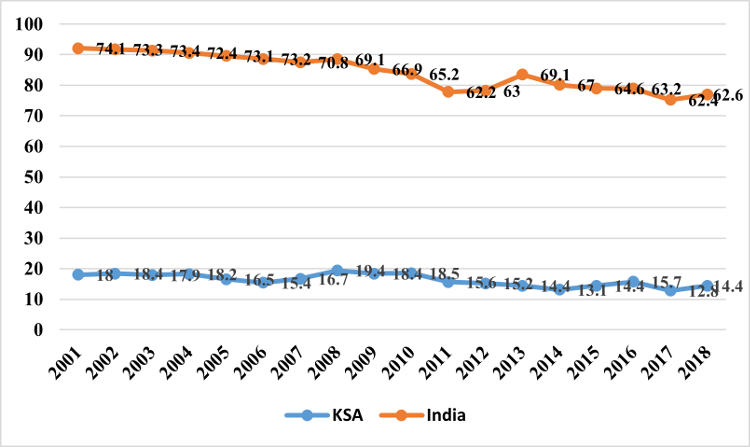

OOPE constituted 62.4% of total health expenditure in India in 2014 (24). Last two decades witnessed a series of health system reforms with overarching goal of strengthening the public healthcare system in both rural and urban areas, as well as government sponsored health insurance. However, there has been marginal decline in overall OOPE (Fig 2). Findings of national health surveys reveal that a significant proportion of population utilizes private healthcare facilities by incurring OOPE. Currently, the private health sector contributed to a significant share in terms of health workforce, number of hospitals, and medical education institutions than the public health system (8, 25). Between 2002 and 2010, private sector contributed to almost 70% of increase in all hospitals in India (26). However, there are certain issues and challenges with the private sector proliferation in terms unethical practice, quality of care and cost of services.

|

Fig 2: Out-of-pocket expenditure on healthcare in India and KSA (in % of current health expenditure (2001-2018) |

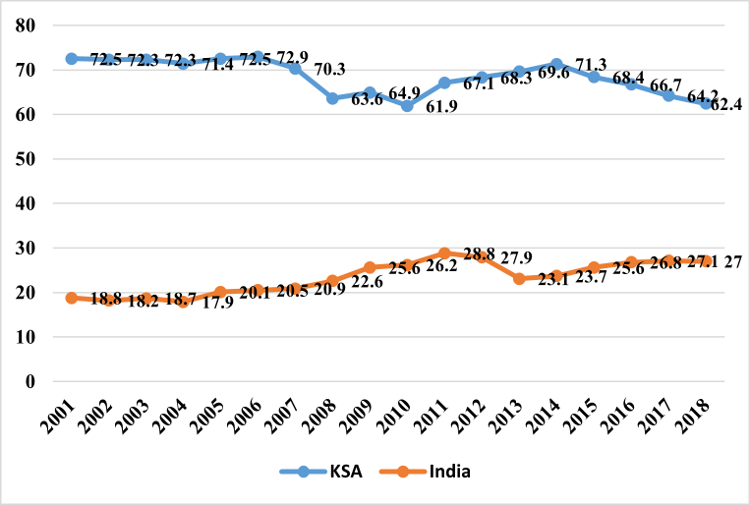

In KSA, the government allocated a substantial amount of resources to health sector, which enhanced the availability of primary, secondary and tertiary health services across the country. With the introduction of healthcare reforms encouraging private sector participation, the share of government in total healthcare expenditure has gradually declined from 75.2% (2001) to 62.4% (2018). On the other hand, the share of private health expenditure increased from 27.5% (2001) to 37.6% (2018). However, India's share of government expenditure on healthcare not only low but also fluctuated over the period of time (Fig 3.)

|

Fig 3: General government health expenditure as % of current health expenditure - India and KSA, 2001-2018

|

In India, there was a decline of 2.5% in OOPE between 2010 and 2018; while the government expenditure on healthcare increased by 0.74% (Table 2). During this period, KSA has also recorded a 4% decline of OOPE and 0.5% increase in government expenditure to total healthcare expenditure.

| Table 2: Healthcare spending in India and KSA, 2010 and 2018 |

| Healthcare financing |

India |

KSA |

2010 |

2018 |

Change |

2010 |

2018 |

Change |

Current healthcare expenditure as a share of GDP |

3.27 |

3.6 |

0.33 |

3.64 |

6.36 |

2.72 |

Government expenditure as % of current health expenditure |

26.21 |

26.95 |

0.74 |

61.93 |

62.43 |

0.5 |

Out-of-pocket expenditure on health (in %) |

65.18 |

62.66 |

-2.52 |

18.95 |

14.36 |

-4.6 |

| Source: WHO. Global health expenditure data base |

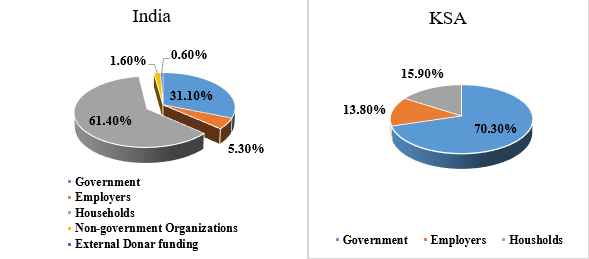

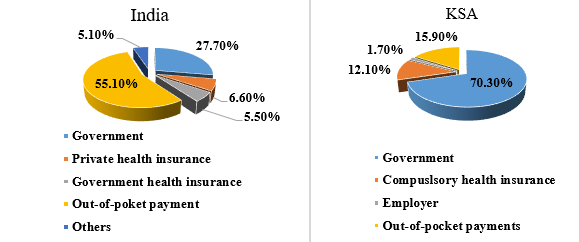

According to the latest National Health Accounts published by KSA [27] for the year 2017-18, the major share of healthcare expenditure comes from the government (70.30%), followed by the household sector (15.90%). Employers contribution to health insurance of workers in the private sector constitutes 13.80% of total healthcare expenditure (Fig 4). In India, households incurred 61.40% of total healthcare spending, whereas the government's contribution is 31.10% and employer's contribution towards health insurance of workers accounts for 5.30%.

|

Fig 4: Where did the funds come from - NHA estimates 2017-18 for India and KSA

|

In India, both central and state governments together pool 27.7% of funds for delivering primary, secondary and tertiary care services as well as for implementing various health schemes. They also pooled their funds for implementing health insurance schemes (5.5%) for different segments of population (28).

|

Fig 5: Which schemes pooled the funds -NHA

estimates 2017-18 for India and KSA |

Households funds are channelled into healthcare system through out-of-pocket payment (55.1%) and premiums on private health insurance (6.6%) (Fig 5). In KSA, the government manages all its funds to deliver healthcare through the MOH and other government agencies while private sector manages their funds either through prepayment schemes or out-of-pocket payment.

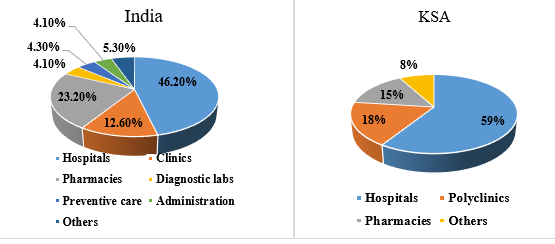

Of the total expenditure incurred during 2017-18 in India, hospitals received 46.2% of total healthcare funds, clinics received 2.6% funds, pharmacies received 23.2%, diagnostic labs received 4.2%, and preventive care received 4.3% of funds (Fig 6). In KSA, almost 59% of healthcare funds received by hospitals, 18% of funds by clinics and polyclinics, 15% pharmacies and 8% funds incurred for health system governance. KSA's expenditure on hospital care is one of the highest in the world, while the average for the OECD countries is only 38% (27).

|

Fig 6: Which providers received the funds -NHA estimates 2017-18 for India and KSA

|

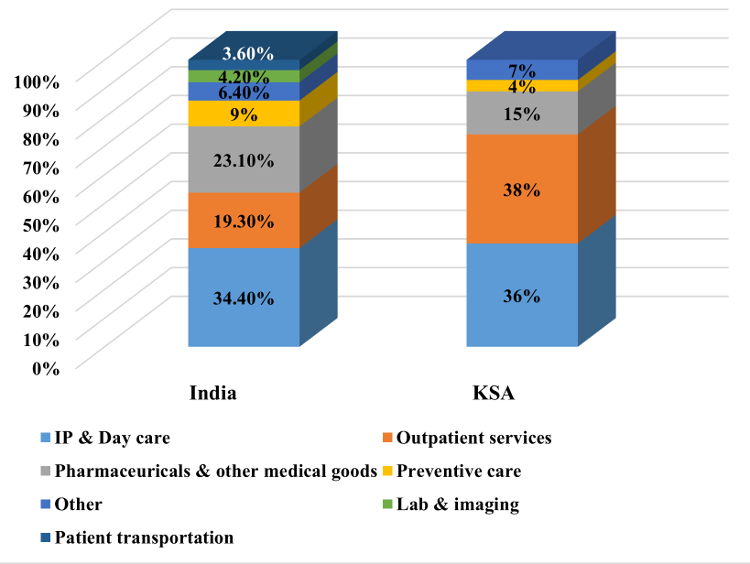

Fig 7 shows that 34.4% of healthcare funds in India were attributed to delivering inpatient and day care, 19.3% funds attributed for outpatient care, 23.1% for pharmaceuticals and other medical goods 9% for preventive care, 4.2% for lab and imaging services, 3.6% for patient transportation and 6.4% attributed to healthcare governance. In KSA, 36% of healthcare funds in KSA was used for delivering inpatient care and day care, 38% funds was used for outpatient care, 15% for drugs and other goods and services, 4% for preventive care and 7% for healthcare governance and others.

|

Fig 7: What services were purchased- NHA estimates 2017-18 for India and KSA

|

Health System Capacity

In India, the public sector delivers a comprehensive healthcare through its larger network of healthcare facilities which include 40883 government hospitals (8,18,396 beds), 5685 community health centres, 20069 primary health centres, and 152794 sub-health centres in rural and urban areas (22). On the other hand, private sector has an estimated 43,486 hospitals, with 1.18 million beds (29). With regard to healthcare professionals, India has a total number of nearly1.23 million doctors in the modern medicine, about 0.28 million dental surgeons and 0.80 million doctors in the Indian system of medicine registered with their respective councils in different states. There are about 0.88 million auxiliary nurse mid wives, 2.1 million registered nurses & midwives, and 0.06 million lady health visitors working in different states. Besides, there are about 1.2 million pharmacists registered with pharmacy council in 2020 (22). Number of medical colleges in India has increased from 146 in 1991-92 with admission capacity of 12199 seats to 542 medical colleges with admission capacity of 81400 in 2019-20. Despite producing adequate health workforce in the country, their total share in government sector is significantly low. For instance, according to the latest MOH&FW report, only 141681 doctors in modern medicine and 8040 dental surgeons are working in the government sector.

In KSA, the MOH delivers healthcare through 287 hospitals, which encompasses 45180 beds and 2257 primary health care (PHC) centres; while other government agencies provide health services to defined population through 50 hospitals with 13989 hospital beds. The private health sector has 267 hospitals with 19427 beds and 3005 medical complexes (13). However, the health care system faces certain challenges like inefficiency due to lack of coordination, inequity in access to health care for all individuals and these challenges lead to duplication of efforts and wastages of resources (18).

|

Fig 8: Number of hospital beds per 1000 Population-India and KSA (2001-2017) |

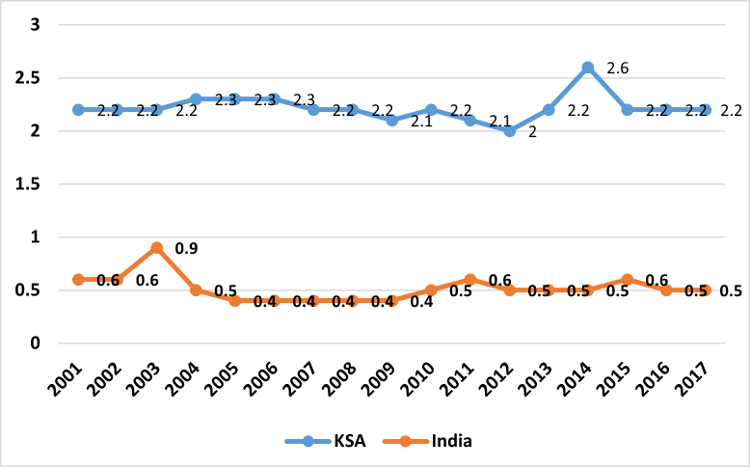

While Saudi health system is primarily government based, the Indian health care system provides a mixed framework with the domination of private health sector. Density of health workforce and hospitals beds in India are very low compared to KSA (Table 3). Although density of hospital beds per 1000 population has not increased significantly between 2010 and 2018 in both countries, yet India's density of hospital beds per 1000 population in 2018 is much lower compared to KSA (Figure 8).

| Table 3: Health system capacity, India and KSA (2010-2018) |

| Density (per 1000 population) |

India |

KSA |

2010 |

2018 |

Change |

2010 |

2018 |

Change |

Physicians |

0.68 |

0.92 |

0.24 |

2.40 |

2.61 |

0.21 |

Nurses & midwives |

0.87 |

1.72 |

0.85 |

4.73 |

5.47 |

0.74 |

Hospital beds |

0.47 |

0.53 |

0.06 |

2.20 |

2.30 |

0.1 |

Mental health personnel per 100, 000 population |

1.24 |

1.93* |

0.69 |

22.0 |

19.4* |

-2.6 |

| Source: WHO. Global health expenditure data base,* data for

2017. |

Although India has more number of doctors in terms of sheer size, the density per 1000 population is 0.92 in 2018 compared to 2.61 in KSA, despite the Kingdom is heavily dependent on expatriate health workforce for delivery of healthcare services (30). The density of nurses and midwives per 1000 population in India is also much lower compared to KSA. Number of mental health professionals per 100,000 population in India (1.93) is almost 10 times lower than KSA (19.4) in 2018.

Population Health

Life expectancy at birth in India was below the of KSA, and this has been below for over the past several years. With regards to mortality rates, there has been sharp decline in the mortality rates in both countries, but India's mortality rates are much higher than KSA. India has experienced a significant improvement in health indicators over the last 2 decades. Infant mortality rate per 1000 live births declined from 52 in 2010 to 28.3 in 2018. Under-five and neonatal mortality rates have declined considerably (Table 4). India's maternal mortality rate has declined from 201 per 100,000 live births in 2010 to 145 in 2017.

Health system in KSA has had a remarkable transformation and results in significant improvement in population health. Life expectancy at birth has increased overtime between 1960 and 2019. Infant mortality has significantly dropped from more than 100 per 1000 live births in 1970 to 2 per 1000 live births in 2019. There has been consistent decline in infant mortality, neonatal mortality and under-five mortality rates due to improvement in healthcare quality. Maternal mortality rate in KSA has steadily decreased from 25 per 100,000 live births in 2000 to 17 per 100,000 per live births in 2017, which is almost 8.5 times lower than maternal mortality rate in India (12).

According to the WHO, 63% of all deaths in India are accounted by NCDs, which mainly include cardio-vascular diseases (27%), Chronic respiratory diseases (11%), cancers (9%), and diabetes (3%). Other NCDs cause about 13% of all deaths in 2017. Along with NCDs, India has been facing the challenges in reducing communicable diseases such as tuberculosis incidence rates, which is one of the highest rates in the world. Almost 26% of all deaths in 2017 was due to communicable, maternal, perinatal and nutritional related conditions.

| Table 4: Health status indicators, India and KSA (2010-2019) |

| Indicators |

India |

KSA |

2010 |

2019 |

Change |

2010 |

2019 |

Change |

Life expectancy at birth |

64 |

70.8 |

6.8 |

72 |

74.3 |

2.3 |

Infant mortality rate |

52 |

28.3 |

-23.7 |

10.3 |

6 |

-4.3 |

Maternal mortality rate |

201 |

145* |

-56 |

19 |

17* |

-2 |

Under five mortality rate |

69 |

34 |

-35 |

21 |

7 |

-14 |

Neonatal mortality rate |

37 |

22 |

-15 |

6.7 |

4 |

-2.7 |

Tuberculosis incidence per 100, 000 population |

190 |

193 |

3 |

12 |

9.9 |

-2.1 |

Probability of dying from any CVD, cancer, diabetes, CRD between 30-70 years |

23.7 |

21.9 |

-1.8 |

25.7 |

21.3 |

-4.4 |

Causes of death by Non-communicable diseases (in %) |

54.8 |

63* |

9 |

72.4 |

73* |

0.6 |

Age standardized prevalence of tobacco use among persons 15 years and older |

32.6 |

27** |

5.6 |

16.8 |

16.6** |

-0.2 |

| Source: WHO, World health statistics, 2012 & 2020; *data relates to 2017, ** data relates to 2018 |

In KSA, NCDs account for 73% of all deaths, of which cardiovascular diseases constitutes 37%, cancers 10%, diabetes 3% and other NCDs caused 20% of all deaths in 2016.

Mortality due to NCDs in KSA is among the highest in Gulf Cooperation Council (GCC) countries and age-standardized mortality rates is 562 per 100,000 population which was 10% higher than the average of the GCC countries. The probability of dying from any CVD, cancer, diabetes, CRD between 30-70 years was 21.3 in 2019 which is 4.4 less compared to 2010. The major risk factors for NCDs in KSA include use of tobacco, unhealthy diet and physical inactivity. Although the prevalence of tobacco use (12.4%) is lower than global prevalence (18.7%), this prevalence has been increasing among males and females (31). Age standardized prevalence of tobacco use among persons 15 years and older in India is 27 compared to 16.6 in KSA. Overweight and obesity has become one of the major risk factors for NCDs in KSA as data for 2016 shows the prevalence of obesity among children and adolescents 5-19 years was 17.4%, which is more than 8 times compared to 2% in India. Likewise, age standardized prevalence of obesity among adults 18+ years in 2016 was 35.4% in KSA, which is almost 10 times higher than prevalence rate (3.9%) in India.

Discussion

The study shed light on some of the common narratives on the present challenges facing the Indian healthcare system by taking a comparative perspective of KSA. Firstly, India's per capita healthcare expenditure is increasing marginally, and it is not in tandem with the increasing population and particularly the population over the age of 65 years. Secondly, much of the increase in per capita healthcare expenditure comes from private sources than in other healthcare systems. Private healthcare spending in India accounts for about 63 % of total healthcare spending although the expenditure coming from public sources has been increasing, but it may not be adequate enough to finance basic healthcare needs of increasing population.

Based on aggregated data from recent years, KSA consistently spending a higher amount on healthcare as reflected in the share of healthcare expenditure on GDP compared to India. Despite spending higher expenditure on healthcare, KSA still faces the key challenges related to health work force and reduction in NCDs compared to other middle and high income countries (32). Due to low expenditure on healthcare, India's health services outcomes and measures of the population health status are much lower than KSA over the past few decades. The percentage of total public and private healthcare spending on GDP in India is only 3.9% which significantly lower than the world average of 9.9%. These results suggest that, if India wants to achieve higher health outcomes like other higher countries, it needs to invest more on program and activities that can improve health outcomes and health status of population.

Another aspect of healthcare system capacity in India compared with KSA's healthcare system suggest the challenges related to sustainability of care. The number of hospital beds in India is much lower than KSA and well below the average of low and middle income countries of 2.3 in 2017. The number of doctors per 1000 population in India is much lower than KSA counterparts, and is much lower in the public health sector. It is noted that the remuneration for doctors has been the major factor for supply of health professionals, and KSA gives an attractive remuneration to doctors among other benefits compared to India. Therefore, doctors in KSA are less likely to be dissatisfied with their incomes and work environment than in India. This also holds true for nursing and other paramedical professionals, which is considered as one of the major factors for attracting expatriate health workforce in the country.

While the Indian healthcare system works on a hybrid approach of public and private funding and delivery, KSA healthcare system functions profoundly on a government managed, financed and delivered health care system. However, KSA is encouraging the participation of private health providers in financing and delivery of health care as envisaged by the Vision-2030. While KSA has implemented a stringent private healthcare regulation through Royal Decree No. M/40 and ministerial resolution in February 2018 (33), India's private health sector is largely unregulated with diverse type of healthcare providers with varying level of qualifications, medical infrastructure, technical knowledge, standards of care which significantly affecting quality and cost of healthcare (34). Due to heterogeneous nature, enforcement of strict regulations becomes difficult.

According to NHA estimates for 2017-18, out-of-pocket spending remains the major source of healthcare financing in India. Since the government funding on healthcare is low and there are issues related to access to healthcare facilities, a significant portion of outpatient and inpatient care is delivered at private for-profit facilities, with charges typically paid out-of-pocket. As a result, out-of-pocket payments have been the primary means of funding health care, accounting for 62.6% of total health expenditures in 2018. In view of diverse and vast nature of private health sector in India, a bulk of healthcare is provided by the informal health workers especially in rural areas. A study in India showed that only 11% of private healthcare providers in rural areas had a medical degree and only 53% of the, had completed their high school education (35). Although earlier national level surveys showed that private sector has taken a major share of healthcare delivery for decades, data from recent national sample surveys (71st round and 75th round) have shown that there has been significant increase in the use of government health facilities across different states (36).

Indian government launched several medium level strategies to strengthen the delivery of healthcare services in both rural and urban areas. National Rural Health Mission (NRHM) launched in 2005, was aimed at bridging the gap in financial resources allocation of state government by increasing government budget and reducing the burden of OOPE through strengthening the rural healthcare system (37). In 2014, National Urban Health Mission was implemented to improve access to healthcare services for the urban poor (38). The Rashtriya Swasthya Bima Yojana (RSBY), a national health insurance scheme as a potential mechanism to reduce the financial burden of poor households in the unorganized sector was launched. Besides there are state government sponsored health insurance schemes like Rajiv Arogyasri in Andhra Pradesh, Yeshaswini in Karnataka were introduced for the poor population. Gradually, the government's obligations to provide universal health coverage were reflected in health policies and programs.

In September 2018, a largest national health insurance, Ayushman Bharat Pradhan Mantri Jan Arogya Yojana was launched with the aim of providing health coverage to more than 100 million of households in the country. The scheme provides comprehensive secondary and tertiary healthcare packages with annual coverage of Rs,5 lakhs (US$ 6650) per family on floater basis. Besides this scheme, states have implemented their own schemes which provide coverage to 200 million eligible individuals (39). Although these schemes provide hospital-based care for most diseases and pre-existing health problems for the poor individuals, they do not include primary care, outpatient care and high-level tertiary care. It is estimated that 36% of insured individuals in India have private health insurance coverage, mostly cover hospitalization expenses (9).

KSA provides a comprehensive health service to all its citizens and expatriates working in the public sector. However, expatriates and Saudi nationals working in the private sector are mandatory to have employer contributed health insurance. In an effort to extend coverage of health insurance to all workers in the private sector, the Kingdom implemented the cooperative employer based health insurance scheme during the early 2000's in several phases. Currently, this scheme has been successful in providing healthcare to 10.05 million workers and their dependents (6.61 million expatriates and 3.44 million Saudi nationals) in the private sector (21). Under its vision-2030, KSA has been implementing widespread reforms in an attempt to make it as a world class healthcare system by increasing the role of private health sector. Healthcare, is one of the largest insurance segments in KSA, accounting for about 56.8% of total gross written premium in 2018 [40] and it is expected that the ongoing privatization policy driven by the vision 2030 would ensure continuous growth of health insurance market.

NCDs pose a significant public health challenges in both countries mostly due to changing life styles and disease pattern of population. As the population age increases, the prevalence of NCDs and demand for specialized health services are expected to increase largely. KSA is at an early stage of demographic transition to old age population and currently about 4% of its population is above 65+ years. Its life expectancy has increased to 75 years and fertility rate has decreased to 2.5 births per woman. However, it is expected that by 2050 nearly 23% of its population will be reaching above 60 years (41). Hence, it has a prospect for preparing early for an increasing problem of NCDs and their associated risk factors. In 2016, the Kingdom launched a sweeping set of economic reforms with an objective of diversifying and strengthening its economy and enhancing the efficiency of its public sector. In health sector, among other thing, the vision's overarching goal is to improve life expectancy at birth from 74 years to 80 years by 2030. The vision also aimed at scaling up of interventions and programs to prevent NCDs and reduce the resulting economic burden of the society. The public health system in KSA has adopted a new model of care centered around on the patient, on population and on primary healthcare. Under this model, health services are organized into clusters of health providers like accountable care organizations to provide integrated care with high quality and efficiency. This model prioritizes primary and preventive care over costly treatment of diseases with the aim to reduce the existing high hospital care expenditure of the government (42). Currently, expenditure on hospital care including administration accounts for 70% of government health expenditure (27).

India is experiencing a rapid health transition with an increasing burden of NCDs and has twice the odds of dying from these diseases than communicable diseases. Losses due to premature death, morbidity and disability related with NCDs cause substantial adverse consequence on socio-economic development. Risk factors of these diseases include unhealthy diet, tobacco use, alcohol consumption, changing work environment and sedentary life style (43). Individuals suffering from NCDs are mostly in the productive age groups. Although India responded to these challenges by launching a national program in 2010 with emphasis on strengthening health infrastructure, human workforce development, health promotion, early diagnosis, management and referrals, yet the prevalence of NCDs has been increasing. There are significant variations in prevalence among different states. This calls for state specific targets to tackle NCDs. Healthcare systems should play a catalyst role in improving awareness of population through multi-sectoral linkages and policies to reduce risk factors related to NCDs.

Limitations of the study

This research has several limitations. Firstly, the data presented in this paper are purely descriptive in nature; and the author did not do any statistical analysis to determine whether India's performance was statistically different from that of KSA. In many cases, difference between countries and overtime have been influenced by several supply side factors over time. Secondly, the data available to provide a real comparison were limited. In order to ensure validity of the information presented, we selected indicators form sources that have well established processes for validating national data. Thirdly, this paper does not take into account the large differences that exists across Indian states, although few states are progressive than others.

Conclusion

This paper examined four major domains of healthcare system in India and KSA. Overall, KSA has achieved remarkable health outcomes in the past few decades. In comparison with KSA, India spends almost 20 times lower than what KSA spends on healthcare and markedly lower health workforce density. Due to lower healthcare expenditure, India's health services outcomes and health status are low compared to KSA. While India's healthcare delivery is characterized by low access, lower utilization and lower quality, KSA's rapid progress in health outcomes may be attributable to universal health coverage. Nevertheless, percentage of population covered with health insurance in India is higher and burden due to NCDs are lower compared to KSA. While tobacco and alcohol consumption are the major risk factors of NCDs in India; overweight and obesity are becoming major risk factors in KSA. Although Indian healthcare system has undergone notable progress in the last two decades, it is lagging behind in many healthcare system parameters. If India wants to reach a high performing and a nation with good health outcomes comparable with other G20 member countries, it needs to invest more on primary healthcare, health workforce, strengthening public healthcare system, and prevention and treatment for non-communicable diseases. Further, increasing utilization of public healthcare services in India also shows that it is prudent to invest more to strengthen public healthcare delivery system.

References

- Richards M, Thorlby R, Fisher R, Turton C. Unfinished business: an assessment of the national approach to improving cancer services in England 1995-2015. Available at:

https://www.health.org.uk/sites/default/files/upload/publications/2018/Unfinished-business-an-assessment-of-the-national-approach-to-improving-cancer-services-in-england-1995-2015.pdf. Accessed June 21st, 2022.

- Schneider EC, Sarnak DO, Squires D, Shah A et al. International comparison reflects flaws and opportunities for better U.S. health care. Available at: https://www.commonwealthfund. org/publications/fund-reports/2017/jul/mirror-mirror-2017-international-comparison-reflects-flaws-and. Accessed July 2nd, 2022.

- Papanicolas I, Mossialos E, Gundersen A et al. Performance of UK health service compared with other high-income countries: observational study.

BMJ. Clin. Res. 2019;367.

- World Health Organization. WHO global strategy on people-centered and integrated health services. Geneva: WHO; 2015.

- Murray CJL, Frenk J. A framework for assessing the performance of health systems.

Bull. World Health Organ.

2000; 78: 717-31.

- Mathiharan K. The fundamental right to health care.

Issues in Medical Ethics. 2003;11(4):123.

- Thomas SV. The national health bill 2009 and afterwards.

Ann. Indian Acad. Neurol.2009;

12(2): 7.

- Government of India. National Health Policy. New Delhi: Ministry of Health and Family Welfare. Government of India; 2017.

- Common Health Fund. International profile of health systems. Available at: https://www. commonwealthfund.org/sites/default/files/202012/International_Profiles_of_Health_Care_Systems_Dec2020.pdf. Accessed June 22nd, 2022.

- Kumar S. Private sector in healthcare delivery market in India: structure, growth and implications: working paper 185. New Delhi: Institute for Studies in Industrial Development; 2015.

- National Sample Survey Organization. Health in India- NSS 71st round. New Delhi: Ministry of Statistics and Program Implementation. Government of India; 2016.

- World Health Organization. World Health Statistics. Geneva: World Health Organization. 2021.

- Ministry of Health. Statistical Yearbook. Riyadh: Ministry of Health. Kingdom of Saudi Arabia; 2020.

- Al-Dussary DM. Cooperative insurance between theory and practice. Cooperative Insurance Conference. Riyadh:Islamic International Foundation for Economics & Finance. 2009; 1: 18.

- Albejaidi F, Nair KS. Building the health workforce: Saudi Arabia's challenges in achieving Vision 2030.

Int J Health Plann Manage. 2019: 1-12.

- Mufti MH. A case for user charges in public hospitals.

Saudi Med J. 2001; 21(1): 5-7.

- Ministry of Health. Budget -2021. Available at:

https://www.moh.gov.sa/en/Ministry/About/Pages/Budget.aspx

Ministry/ About/Pages/Budget.aspx. Accessed August 2nd, 2022.

- Almalki M, FitzGerald G, Clark M. Health care system in Saudi Arabia: An overview.

East Mediterr Health J. 2011;17(10):784-93.

- Young Y, Alharthy A, Hosler AS. Transformation of Saudi Arabia's health system and its impact on population health: what can the US learn?

Saudi J Health Syst Res. 2021; 1:93-102.

- Kingdom of Saudi Arabia. Saudi Arabia's Vision 2030. Available at: http//www. vision2030.gov.sa/en/ ntp.11. Accessed 15th July, 2022.

- Argaam. Saudi health insurance subscribers decline 10% to 10.05 mln in 2020. Available at:

https://www.argaam.com/en/article/articledetail/id/1434997. Accessed August 11th, 2022.

- Ministry of Health & Family Welfare. National health profile. New Delhi: Central Bureau of Health Intelligence. Government of India; 2020.

- Malhotra S, Patnaik I, Roy S, Shah A. Fair play in Indian health insurance. Working paper series no.228. New Delhi: National Institute of Public Finance and Policy; 2018.

- The World Bank. The World Bank Data. 2014. Available at: http://data. worldbank.org/ country/india. Accessed September 12th, 2022.

- Karan A, Negandhi, Nair R et al. Size, composition and distribution of human resources for health in India: new estimates using national sample survey and registry data.

BMJ Open. 2019; 9:e025979.doi:10.1136/bmjopen-2018-025979.

- Gudwani A, Mitra P, Puri A, Vaidya M. India healthcare: inspiring possibilities, challenging journey. New York: McKinsey & Co; 2012.

- Saudi Health Council. National health accounts 2017-18. Riyadh: Kingdom of Saudi Arabia; 2020.

- Ministry of Health & Family Welfare. National health accounts estimate for India 2017-18. New Delhi: National Health Systems Resource Centre. Government of India; 2021.

- Sankar A. Private healthcare in India: boons and banes. Institut Montaigne; 2020. Available at:https://www.institutmontaigne.org/en/blog/private-healthcare-india-boons-and-banes. Accessed September 15th, 2022.

- Albejaidi F, Nair KS. Nationalisation of health workforce in Saudi Arabia's public and privatesectors: a review of issues and challenges.

J. Health Manag. 2021; 23 (3). DOI: 10.1177/09720634211035204.

- World Health Organization. Non-communicable diseases country profile Saudi Arabia. 2018. Available at: https://www.who.int/nmh/countrie s/sau_en.pdf? ua=1. Accessed October 3rd, 2022.

- Albejaidi F, Nair KS. Addressing the burden of non-communicable diseases: Saudi Arabia's challenges in achieving Vision 2030. J. Pharm. Res. Int. 2021; 33(35A): 34-44.

- Ministry of Health. Law of private health institutions. Available at: https://www.moh. gov.sa/en/Ministry/Rules/ Documents/ Private-Health-Institutions-Law.pdf. Accessed August 3rd, 2022.

- Nair KS, Pasha SA. Unregulated private health sector: India's challenges in realizing universal health coverage.

Public Policy Adm. 2020; 10(3), 51-60.

- Das J, Holla A, Das V, Mahajan M, Tabak D, Chan B. In urban and rural India, a standardized patient study showed low levels of provider training and huge quality gaps.

Health Aff. 2012; 31: 2774-84.

- Muraleedharan VR, Vaidyanathan G, Sundararaman T, et al. What do NSSO 71st and 75th rounds say? Invest more in public health facilities.

Econ Polit Wkly. 2020; 55(37): 53-60.

- Ministry of Health and Family Welfare. National Rural Health Mission- Framework for implementation. New Delhi: Government of India; 2005.

- Ministry of Health and Family Welfare. National Urban Health Mission- Framework for implementation. New Delhi: Government of India; 2014.

- Kumar A, Rakesh S. Health insurance for India's missing middle. New Delhi: NITI Aayog, Government of India; 2021.

- Saudi Arabian Monitory Agency. Saudi Insurance Market Report. Riyadh: Kingdom of Saudi Arabia; 2020.

- Economic and Social Commission for Western Asia. Regional profile of the Arab region demographic of ageing: trends, patterns, and prospects into 2030 and 2050.Technical paper no.7. Beirut; 2017.

- Alqunaibet A, Herbst CH, Saharty, Algwizani A.(eds). Non-communicable diseases in Saudi Arabia: towards effective interventions for prevention. Washington DC: World Bank Group; 2021.

- Nethan S, Sinha D, Mehrotra R. Non communicable disease risk factors and their trends in India. Asian Pac. J. Cancer Prev. 2017;18(7): 2005-2010.

|